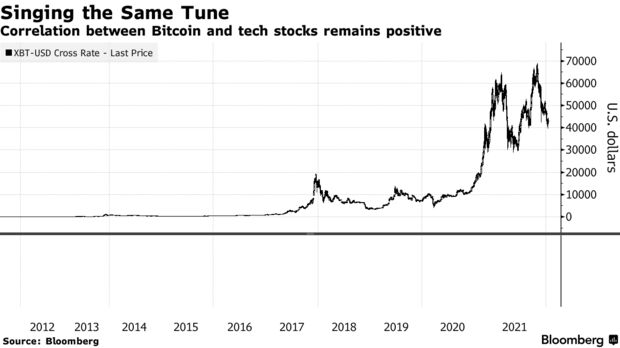

Practically all week, cryptocurrencies have twisted and turned in the same way technology stocks have, with both sets of assets coming under pressure as the Federal Reserve becomes more hawkish with its policy.

Marko Papic, chief strategist at Clocktower Group, agrees. Bitcoin “is a high-beta risk asset,” he said, adding that “in an environment where the Fed is becoming more hawkish, you don’t really want to own high-beta risk assets.”

The 100-day correlation coefficient of the coin and the Nasdaq 100 now stands at 0.40, among the highest such readings going back to 2011. (A coefficient of 1 means the assets are moving in lockstep, while minus-1 would show they’re moving in opposite directions.)

“People are stepping back and saying, OK, what is Bitcoin?,” Victoria Greene, founding partner and chief investment officer at G Squared Private Wealth, said by phone. “Bitcoin is showing a lot more tendency to track with and correlate with the Nasdaq and the market than it is with inflation and uncorrelated currency.”Your key to the crypto universe.Introducing the Bloomberg Crypto newsletter.EmailSign UpBy submitting my information, I agree to the Privacy Policy and Terms of Service and to receive offers and promotions from Bloomberg.

For most of its 13-year history, Bitcoin has enjoyed an environment of easy monetary policy and zero or negative rates. But both stocks and cryptocurrencies have been volatile as of late as the Fed prepares to withdraw pandemic-era stimulus that had been in place for the past two years. While there is no straight through-line from the Fed’s coffers to Bitcoin buy-orders on exchanges, there is a connection, according to analysts who say that less money in the system means fewer dollars going toward crypto, too.

Read more: Crypto Diehards Are About to Find Out If It Really Was a Bubble

“If this continues in terms of the correlation, we think that crypto could lose its appeal as a hedge and we’re starting to see that right now,” said Anderson Lafontant, senior adviser of advanced planning at Miracle Mile Advisors.

— With assistance by Emily Graffeo, and Elaine Chen(Updates prices throughout.)

Have a confidential tip for our reporters?Get in touchBefore it’s here, it’s on theBloomberg TerminalLearn moreLIVE ON BLOOMBERGWatch Live TVListen to Live Radio

Crypto

Follow us

Featured

Bitcoin Went Mainstream in 2021. It’s Just as Volatile as EverBloomberg’s Best Reads This Year, According to Our ReadersA Wild, Emotional Year Has Changed Investing—Maybe ForeverCryptoBots Are Overrunning Crypto Networks Like Solana as They Hunt for Profitsby Olga KharifDeFi Project Known as Wormhole Hit With a Potential $320 Million HackU.K. Tax Regulator Toughens DeFi Stance and Crypto Isn’t HappyCryptoBiggest Texas Bitcoin Miner Shuts Down Ahead of Cold Blastby Michael Smith

Crypto 101

How to Buy Bitcoin: A Guide to Investing in the Cryptocurrency

Americans Still Don’t Understand How Bitcoin Works

Traders Piling Into Overvalued Crypto Funds Risk a Painful Exit

All the Bitcoin Lingo You Need to Know as Crypto Heats Up

The $50 Trillion Industry Making a Huge Bet on Blockchain

Blockchain may one day eliminate inefficiencies and lack of transparency in supply chains. While slow in coming, this revolution would benefit not only customers and brands, but the “invisible” workers who power global trade. (Source: Bloomberg)

SEC’s Meme Stock Response Coming Next Week, Gensler Says

Facebook Shares Plummet Due to Stalled Growth

The Global Crackdown on Press Freedom

The Assault on Apple Daily

The Fundamentals

Ether Founder Doubts Silicon Valley Threat: The Week in Crypto

How Hackers Bled 118 Bitcoins Out of Covid Researchers in U.S.

Does Bitcoin Boom Mean ‘Better Gold’ or Bigger Bubble? QuickTake

What’s Ahead for Cryptocurrencies in 2021?

More on Crypto

Bitcoin Lovers Like the Winklevoss Twins Urge Patience After DeclinesAkayla GardnerSilvergate Keeps Its Stablecoin Dream Alive After Diem PurchaseOlga KharifBotswana to Regulate Crypto That Was Feared Becoming ‘Wild West’Mbongeni MguniSouth African Crypto Traders Warned Over Using Exchange FTXLoni Prinsloo and Adelaide ChangoleBitcoin’s Trendline From Peak Keeps Pressure on TokenAkshay ChinchalkarBitcoin’s Dip From Two-Week Peak Highlights Key Technical HurdleAkshay ChinchalkarIndia Says Crypto Not Illegal as It’s Taxed Like Gambling WinVrishti BeniwalEther’s Correlation With Stocks Reaches a Record HighSunil JagtianiMicroStrategy Posts a Loss After Taking Bitcoin Impairment ChargeCrystal Kim and Tom ContilianoBitcoin Halving Will Stir Next Crypto Frenzy, Thai Exchange SaysRandy Thanthong-Knight and Anuchit NguyenAlexis Ohanian’s VC Fund Raises $510 Million for Crypto StartupsIlena PengDorsey Says Zuckerberg Should Have Focused on Bitcoin, Not DiemKurt WagnerBitcoin Touches Highest in Two Weeks as Traders Look for BottomAkayla GardnerAfter Football, Tom Brady Will Work on His NFT, Apparel and Fitness BusinessesKim BhasinMicroStrategy Bought $25 Million in Bitcoin Amid SlideCrystal KimSolana Adds Payment Feature Amid Crypto Network Congestion WoesOlga KharifNew York City Leads Crypto-VC Funding Race Over Silicon ValleyAkayla GardnerSEC’s Lone Republican Warns of Threat to Crypto DeFi Platforms in New Agency PlanAllyson VersprilleBestEx Research Expands Futures Offering Abroad, Adds CryptoKatherine DohertyRussia Values Local Crypto at $200 Billion as Rules NearEvgenia PismennayaStrugging IPOs Give FTX CEO Pause on Taking His Crypto Giant PublicVildana Hajric and Katie GreifeldKanye West Is Staying Out of the $44 Billion NFT Market, For NowLisa FleisherBarclays Junk Bond Trader Leaves Bank to Seek Fortune With NFTsAbhinav Ramnarayan and Laura BenitezIndia Finally Warms to Crypto With Tax, Digital CurrencySuvashree Ghosh and Vrishti BeniwalBitcoin’s Record Casts Long Shadow Over Its Recovery OddsAkshay ChinchalkarMeta-Backed Diem Association Confirms Asset Sale to SilvergateOlga KharifWonderland Community Votes to Keep DeFi Project Going After ScandalEmily NicolleCoinbase-Backed Crypto Lobby Group Gears Up for Regulation With New LeaderAllyson VersprilleCoinbase Adds Shopify Founder Lütke to Board Amid Consumer PushOlga KharifSam Bankman-Fried’s FTX Raises Another $400 Million With Eye to M&AVildana Hajric and Katie GreifeldEx-Official Warns BOJ Against Using Digital Yen to Juice PolicyToru Fujioka and Sumio ItoBinance Restricts Nigerian Crypto Accounts on Security ConcernEmele Onu

source https://duchonsigns.wordpress.com/2022/02/06/bitcoin-investing-clocktower-says-avoid-high-beta-risk-assets-as-fed-tightens/

No comments:

Post a Comment